Survey Shows Fast, Reliable Screening is Crucial to Bringing Back Live Events

The Harris Poll survey shows event-goers are just as concerned about physical safety as COVID protection – and not satisfied with traditional metal detectors.

While these days we all yearn to return to some semblance of normal life, most aren’t going to feel comfortable returning to concerts, sporting events and the like for several months after the pandemic has subsided. The reluctance largely has to do with screening methods that, while necessary and welcome, create lines and crowding that are unacceptable to large swaths of would-be event attendees.

This is one finding from a survey of more than 500 people who attended a concert, sporting event or other live, ticketed event in 2019. Conducted by The Harris Poll in mid-Sept. through early October 2020, the survey made it clear attendees want to see both adequate COVID-related measures in place as well as traditional safety precautions such as metal detectors – but without the lines. It’s a result that should have sports teams, event producers and venue facility managers looking for new ways to make attendees feel comfortable with screening processes while greatly increasing their efficiency and effectiveness.

Social distancing is top of mind

Survey respondents made clear they’re more comfortable returning to events such as conferences, workshops and conventions where social distancing is more easily accomplished and enforced. On average, respondents said they’d be comfortable attending such events within two to three months after federal, state and local restrictions allow (see Figure 1). For events that are generally more crowded, like concerts and sporting events, the median was four to six months.

Figure 1

That finding is consistent with The Harris Poll’s ongoing COVID-19 Tracker surveys, said Erica Parker, Managing Director at The Harris Poll, who recently joined me for a webinar to go over the results.

“It’s clear from that kind of data that it’s a bigger lift to get people to ticketed events,” as compared to dining at a restaurant or returning to the office, she said. “Venue and facility managers are going to need to do some work to restore public confidence and get people back and feeling comfortable doing these activities.”

Part of the issue is, unlike some workers and school-aged children, consumers have the luxury of simply opting not to go to events. They can also be choosier about the protocols in place before they’re willing to return.

Safety concerns run deeper than COVID

What’s more, it’s not just COVID-19 that has folks concerned. While 81% of survey respondents said they are concerned or very concerned about the pandemic, other issues garner the same or even more concern:

- Mass shootings: 83% concerned or very concerned

- Street crime – 82%

- Protest-related civil unrest/violence – 81%

- Terrorism – 72%

81% of event attendees are concerned about COVID-19 but even more are concerned about mass shootings (83%) and street crime (82%).

Nearly three-quarters of respondents (71%) believe crime has increased over the past year. In the Midwest, the figure is 79% vs. 63% in the South. Residents in rural areas are likewise more likely to think crime is on the rise, 82% vs. 62% for suburbanites.

All this adds up to 69% of respondents believing the risk of violence in public spaces is higher than it was a year ago. Nearly 3 in 10 respondents (28%) say it’s unsafe to go out in public. That’s especially true in the Northeast (35%) but far less so in the Midwest (18%).

69% of respondents think the risk of violence in public spaces is higher than a year ago. Nearly 3 in 10 say it’s unsafe to go out in public.

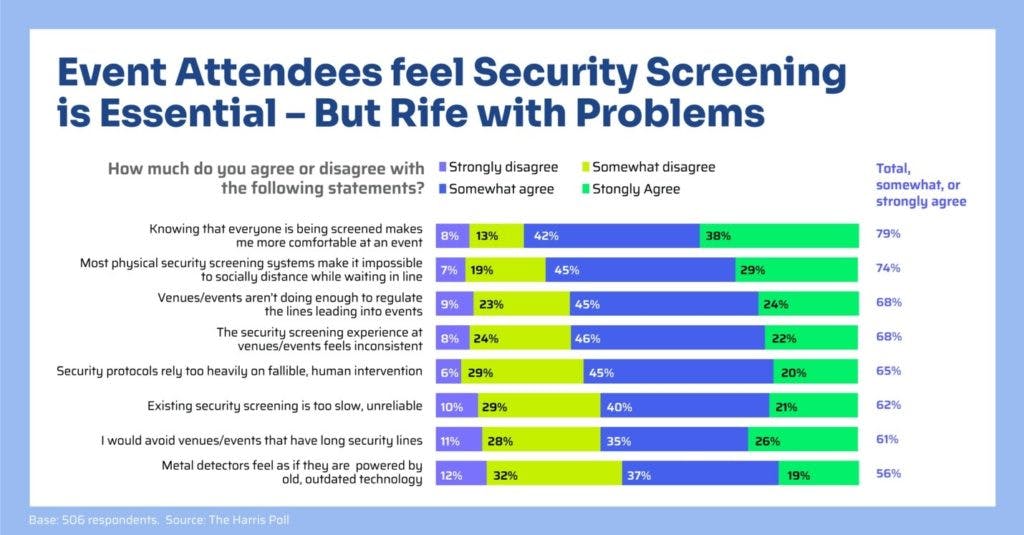

Against that backdrop, it’s not hard to understand why 79% of survey respondents either agree or strongly agree that screening makes them feel more comfortable at events. This is the case even though they cite numerous problems with traditional screening measures, from lines that slow the process and make social distancing impossible to relying on fallible human intervention (see Figure 2).

Figure 2

On the other hand, respondents clearly appreciate efforts to make screening safer and more efficient post-pandemic. Asked how likely they are to return to a venue that has various features in place, 86% said they were somewhat or strongly likely to visit venues that have hand sanitizer stations and touchless screening in place along with plexiglass shields (85%). Other desirable features include:

- Walk-through body temperature measurements: 84%

- Social distancing floor markings: 84%

- Mandatory face masks: 81%

- Handheld thermometer checks: 79%

Protecting venues

Traditional metal detector screens, which require attendees to empty their bags and pockets, and potentially be subject to a pat-down, still induce more positive than negative feelings. But the negatives are significant.

Asked how this type of screening would make them feel, 75% said “calm” but nearly a third (32%) said “anxious.” And while 73% said it would make them “confident,” more than one in five (21%) said they’d be “fearful.” Nearly three-quarters (74%) said the screening would make them feel “satisfied” but 30% said they’d be “irritated.” Anxious, fearful and irritated is no way to enjoy an event.

Respondents were also asked what risks they would be willing to accept during a mid-pandemic screening process. The answers point to more challenges for venue operators and managers, as attendees will not tolerate use of outdated technology (61%), slow or inefficient screening processes (58%), false positives, meaning mistaking a harmless item for a weapon (52%), and even the possibility of human error (50%).

Perhaps most telling, nearly two-thirds of respondents (63%) said they would simply not join a line in which people were not socially distancing. Think about that: it means someone has a ticket to an event, gets to the venue, sees a line that violates social distancing guidelines and decides to forego the event.

“When you think about the intersection of COVID and metal detector screening, and the fact that it can create long security lines, [event attendees are] not interested in that,” The Harris Poll’s Parker said. Newer technology can make a difference, though. “We find that 87% are likely to return to facilities and venues if there was a touchless security screening,” she said.

The vast majority of respondents (87%) say they are likely to return to facilities and venues if touchless security screening is in place.

That makes sense because newer touchless security screening systems create an altogether different experience. There’s no need to empty pockets, because the system can detect items that are in your pockets and differentiate, say, a gun from a metal keychain or phone. By the same token, you can carry bags through the screening system; there’s no need to empty them out. The systems are reliable enough that there are far fewer false positives, which means there’s almost no need for pat-downs.

All of these attributes contribute to another big advantage of touchless systems: they’re much faster. Evolv Express, for example, uses artificial intelligence and advanced sensors to screen up to 3,600 people per hour, about 10 times faster than legacy metal detectors.

New workplace requirements

The Harris Poll makes clear that while COVID-19 is a top concern for event attendees, their physical safety is just as important. But given the COVID requirements for social distancing, it’s equally clear that we need to investigate new ways to keep attendees safe and secure.

Consumers will appreciate facilities that implement a touchless approach, given 79% agreed that knowing everyone is screened upon entering a venue makes them more comfortable. And nearly three quarters (74%) agreed that metal detection systems make it impossible to socially distance while in line.

With a system like Evolv Express, you can get ahead of the curve and ensure potential attendees you value their safety, putting them more at ease – and more likely to attend your events. Click here to learn more.

Watch Digital Threshold Live Episode 3 here:

Download our infographic for additional statistics.